The number 1.5 million can be used to describe multiple things in the United States. For example, there are 1.5 million faculty at degree-granting postsecondary institutions in the U.S. Roughly 1.5 million Americans have lupus, and approximately that same number of individuals served this great country of ours in Iraq between 2003 and 2011.

In the business world, nearly 1.5 million small businesses officially organized as C corporations employ almost 13 million American workers across various industries. The Internal Revenue Service (IRS) classifies C corporations as independent legal entities owned by their shareholders.

The tax requirements for C corporations are somewhat different from those of other U.S. business types. The profit of a C corporation is taxed twice, once as business income at the entity level and again at the shareholder level when distributed as dividends or realized as capital gains. Corporate income taxes are paid at the corporate income tax rate instead of a personal tax rate.

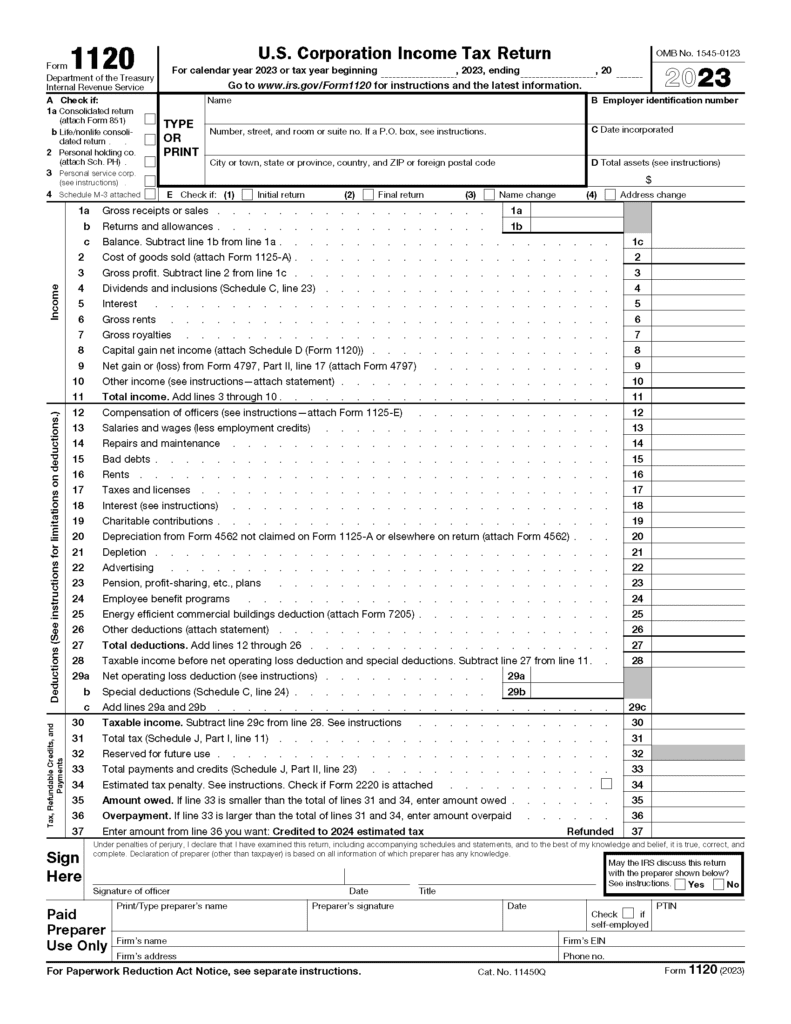

C corporations must file Form 1120, a process that’s complex for individuals without extensive tax knowledge. In this blog, we’ll cover some of the basics of Form 1120, what types of companies should file it and what information is needed to accurately complete it.

What Exactly Is Form 1120: the Corporation Income Tax Return?

Officially titled the U.S. Corporation Income Tax Return, Form 1120 is utilized by C corporations to figure their income tax liability and report their income, gains, losses, deductions and credits. In addition to paying federal income tax, these businesses may be subject to local and state taxes.

Why do C corporations fill out a separate form from other business entities? One reason is that they are designed to shield business owners from certain tax liabilities. These companies have more than 100 shareholders — or ones outside the U.S.

There are numerous variations of Form 1120, including 1120-S, which S corporations use. Others include:

- 1120-C: For cooperatives

- 1120-F: For foreign corporations

- 1120-H: For condominium management and residential real estate management

- 1120-L: For life insurance companies

- 1120-POL: For political organizations

Is Form 1120 for C Corporations or S Corporations?

Unless they are exempt under U.S. Code §501, all domestic corporations are required by the IRS to file Form 1120 annually — even if they do not have taxable income or are in bankruptcy. C corporations include limited liability companies (LLCs) that have elected to be taxed as a corporation. New LLCs utilize IRS Form 8832 to elect how they want to be taxed.

As mentioned earlier in this blog, S corporations file Form 1120-S. Because they do not pay corporate taxes but instead pass their tax liabilities to their individual shareholders, they are categorized as pass-through entities.

What Information Do I Need to Fill Out Form 1120?

One of the reasons Form 1120 can be so “taxing” to complete is that it is six pages long. Another is the amount of information needed to accurately complete it. This financial data consists of details for both operating and non-operating expenses and income.

Other C corporation information used to complete Form 1120 includes:

- Employer Identification Number (EIN)

- Date of incorporation

- Total income and assets

- Gross receipts

- Capital gains

- Tax deductions

- Interest, dividends and royalties earned

- Rents

- Cost of goods sold

When Should Form 1120 Be Filed?

As a guideline, a C corporation must file its Form 1120 by the 15th day of the fourth month after the end of its tax year. Corporations with a fiscal tax year ending June 30 must file by the 15th day of the third month after the end of their tax year.

When expected to owe more than $500 in taxes for the year, C corporations also must pay quarterly estimated tax payments. Such payments are due by the 15th day of the fourth, sixth, ninth and 12th months of the tax year,

If the due date falls on a Saturday, Sunday or a legal holiday, a C corporation can file on the next business day. Businesses that need additional time to file can request a six-month extension using Form 7004. C corporations filing 10 or more returns on or after January 1, 2024 are required to e-file Form 1120. C Corporations failing to file Form 1120 by the due date are subject to penalties based on the time the return is overdue.

Form 1120 Instructions

10 Steps for Filling Out Form 1120

Once you have gathered the necessary materials, follow these steps to fill out Form 1120:

- Download Form 1120.

- Enter the necessary corporation information.

- Calculate all taxable income you received during the year.

- Claim any eligible deductions and credits to reduce your tax liability.

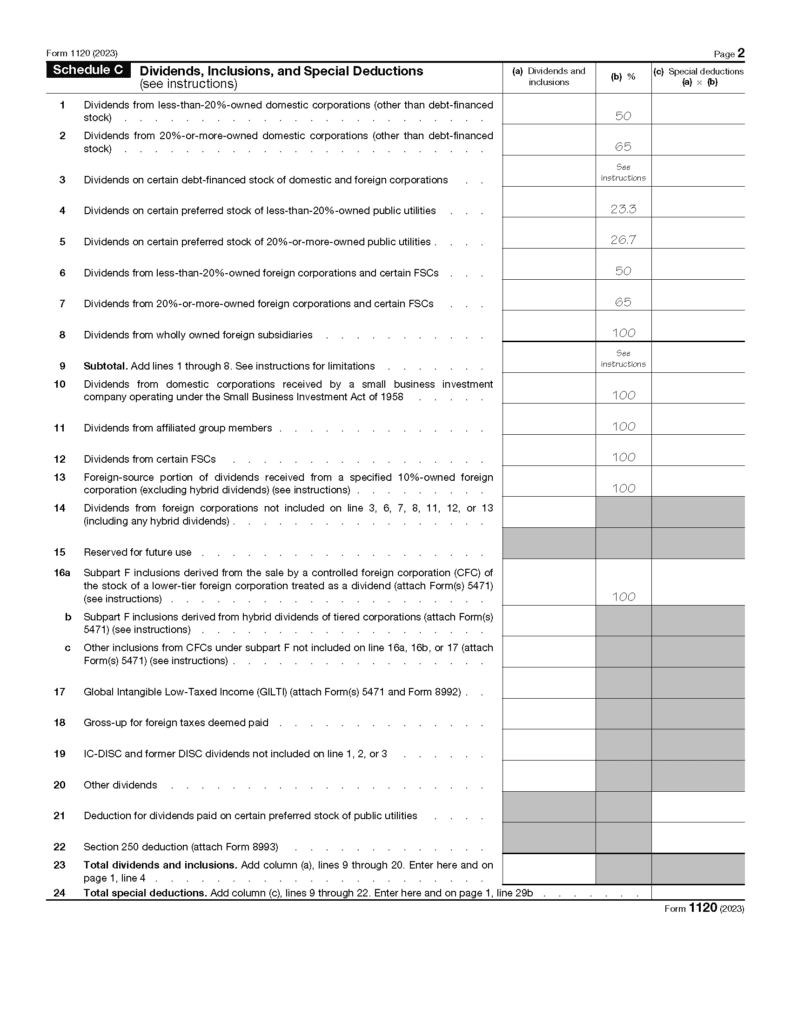

- Fill out page 2 Schedule C: Dividends, Inclusions and Special Deductions.

- Dividends and similar income go on Line 23.

- List any special deductions related to this income on Line 24.

- Complete Schedule J – Tax Computation and Payment — on page 3.

- Part I: Tax Computation

- Part II: Payments and Refundable Credits

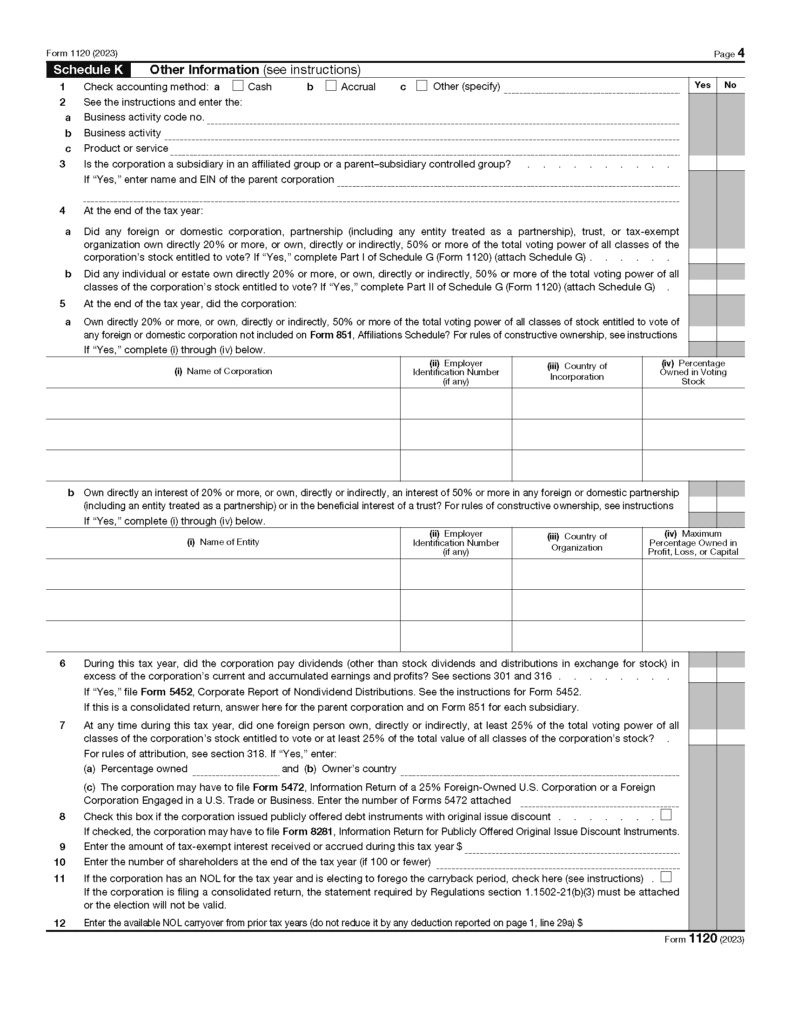

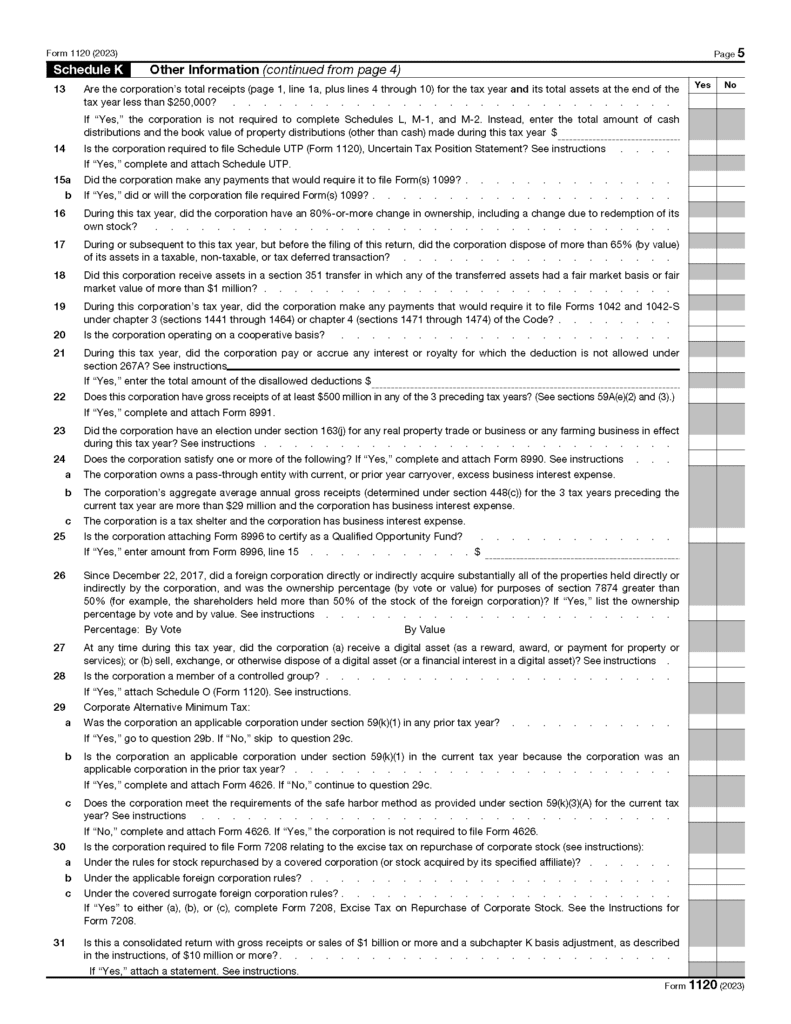

- Complete Schedule K —Other Information — on pages 4 and 5.

- This includes information about the C corporation owners and their investments in other companies.

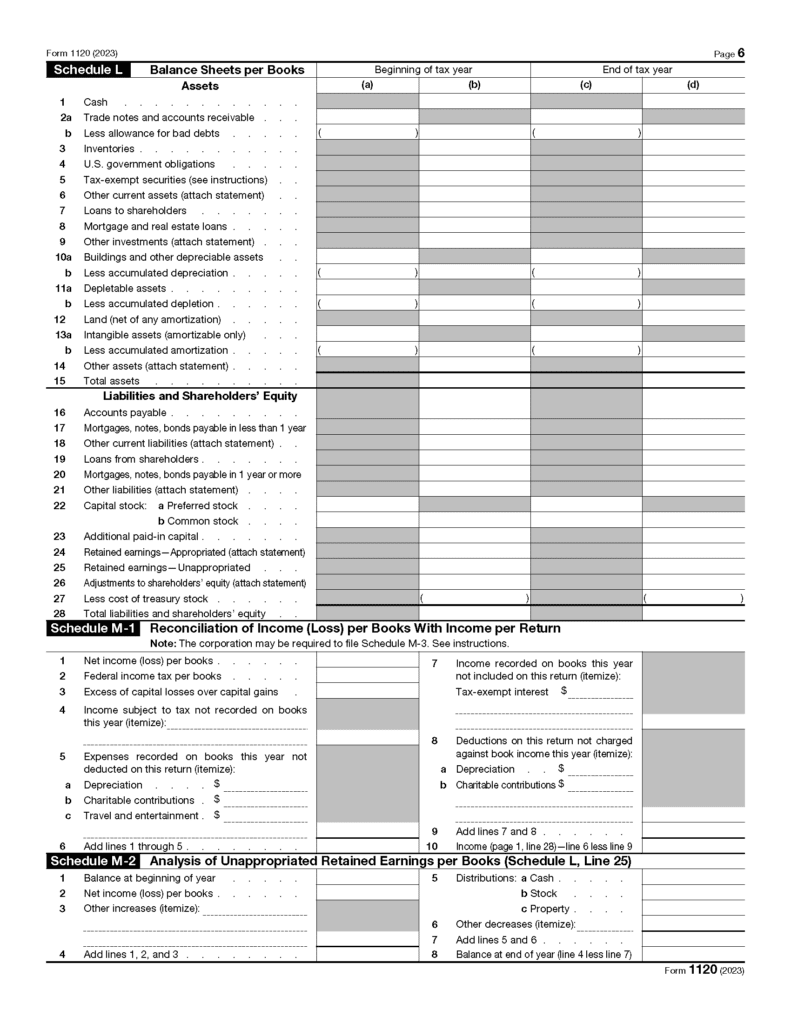

- Complete Schedule L — Balance Sheets per Books — on page 6.

- Use this schedule to report your balance sheet as found in your C corporation’s books and records.

- Complete Schedule M-1 — Reconciliation of Income (Loss) per Books with Income per Return — on page 6.

- This is used to reconcile your accounting (book) income with your taxable income.

- Complete Schedule M-2 — Analysis of Unappropriated Retained Earnings per Books — on page 6.

- This is used to reconcile your C corporation’s unappropriated retained earnings account as found on the beginning of the year and the end of the year balance sheets. Both balance sheets are listed on Schedule L.

At 3Sixty Advisors Tax Services, we offer proactive tax solutions customized for your business. Our team of tax experts understand the complexities and challenges C corporations encounter when managing your taxes. And, our proprietary technology and focus on compliance ensures that your filing is accurate and conforms to all IRS guidelines. Contact us today to learn more!